Best Personal Finance tools (1+)

Discover 1+ best personal finance tools. Compare features, pricing, and reviews. Free and paid options available.

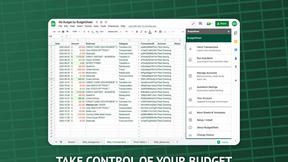

BudgetSheet

Live Bank Data + Google Sheets. The Easiest Way To Import Bank Data Into Google Sheets Automatically.

FAQs for Personal Finance

What are the key benefits of using budgeting tools in the Personal Finance Category?

Budgeting tools in the Personal Finance Category offer crucial benefits, including streamlined tracking of income and expenses. They enable users to identify spending patterns and areas for improvement, allowing for more effective financial management. By fostering discipline and clarity, these tools help users achieve their financial goals.

How does investment guidance improve financial decision-making in the Personal Finance Category?

Investment guidance within the Personal Finance Category significantly enhances financial decision-making by providing users with tailored insights into investment options. This feature helps users evaluate risks and rewards, fostering informed choices that align with their financial goals, ultimately leading to smarter investment strategies.

What unique features does the Personal Finance Category offer for savings optimization?

The Personal Finance Category provides unique savings optimization features that help users compare high-yield savings accounts and identify effective savings strategies. By highlighting options that maximize interest earnings, users can build their savings more efficiently, securing their financial futures through informed decisions.

How does the Personal Finance Category stand out from other financial management tools?

The Personal Finance Category stands out due to its comprehensive approach, integrating budgeting, investment, and savings tools in one user-friendly platform. This unique blend of functionalities ensures users can manage their finances holistically, addressing diverse needs while empowering them to make better financial decisions.

How can users benefit from investment tools in the Personal Finance Category?

Users can greatly benefit from investment tools in the Personal Finance Category by accessing tailored recommendations that guide them toward suitable investment options. These tools enhance users’ understanding of market dynamics, enabling them to build diversified portfolios and make strategic investments that align with their financial goals.

What features help users effectively manage their finances through the Personal Finance Category?

The Personal Finance Category offers features like intuitive budgeting tools, comprehensive investment guidance, and savings optimization resources that collectively help users manage their finances effectively. By simplifying financial tracking and planning, users gain clarity and control over their financial situations, enhancing their overall financial health.

You may also like

Photography

The Photography Category connects photographers with AI tools that optimize workflows and enhance creativity.

Payments

The Payments Category features advanced AI payment solutions for secure, efficient transactions.

Productivity & Management

The Productivity & Management Category offers efficient tools for enhanced workflow management.

Design Tools

The Design Tools Category empowers professionals with innovative tools that enhance creativity and efficiency.

AI Assistants

AI Assistants Category automates tasks, enhancing efficiency with 24/7 support.

Customer Support

The Customer Support Category streamlines support interactions, enhancing satisfaction through targeted assistance.

Knowledge Management

The Knowledge Management Category streamlines knowledge sharing for better collaboration and decision-making.

HR & Recruiting

The HR & Recruiting Category offers AI solutions to enhance hiring efficiency and improve talent acquisition.