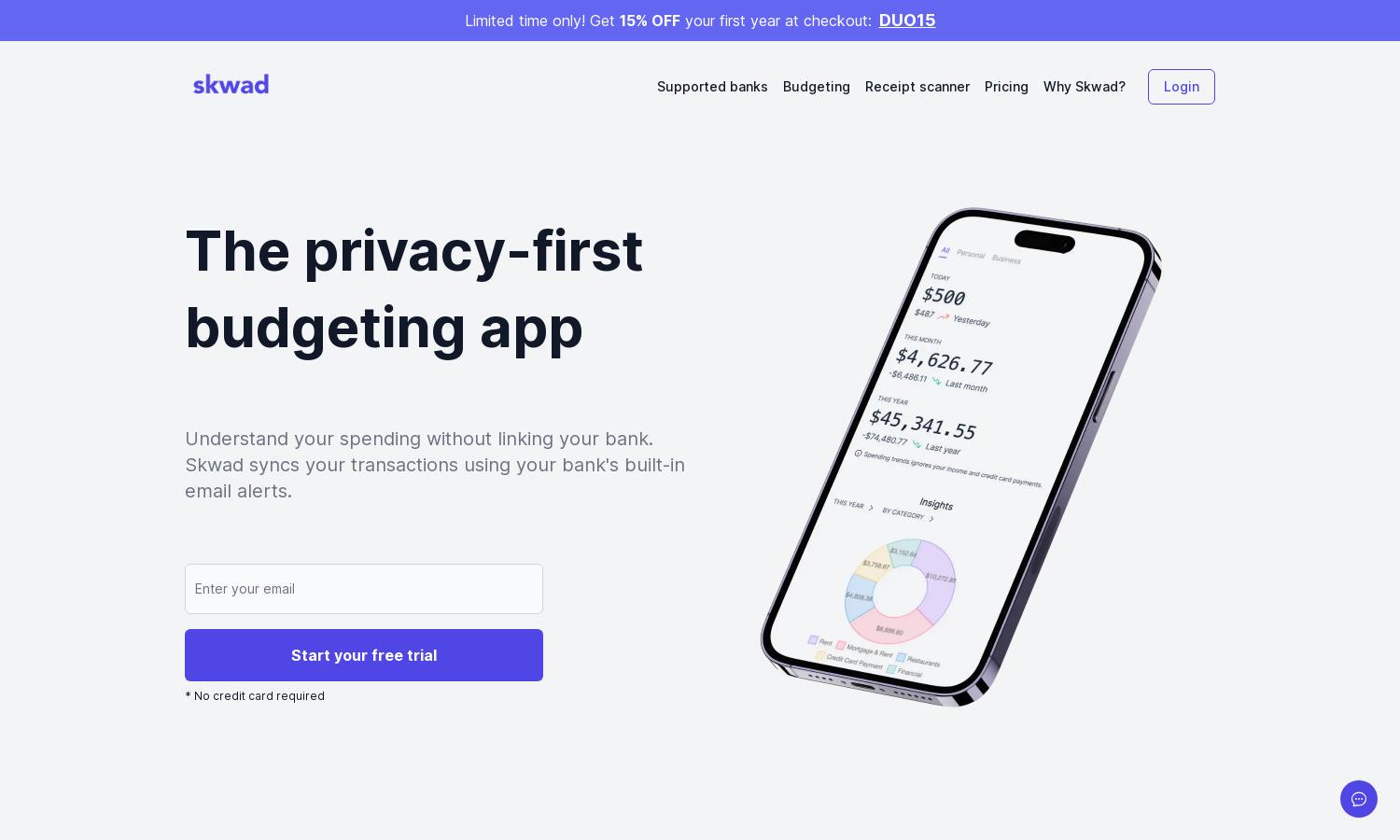

Skwad

About Skwad

Skwad is a budget tracking app that emphasizes user privacy, allowing individuals to manage their finances without risking bank login security. By utilizing email alerts, users can automate transaction tracking and gain insights into their spending habits, ensuring a seamless budgeting experience.

Skwad offers tiered subscription plans catering to various user needs, with a special 15% discount for the first year using code DUO15. Each plan includes features such as advanced expense tracking and customization, enabling users to select the best value for their financial management requirements.

Skwad features a user-friendly interface that simplifies budgeting. Its intuitive design allows users to quickly navigate through their financial data, manage expenses, and categorize transactions effortlessly. Unique features enhance the user experience, ensuring an effective budgeting process without compromising privacy.

How Skwad works

To start using Skwad, users sign up for a dedicated scan email address, allowing them to forward bank alerts securely. By setting up automated spending and income notifications from their banks, transactions are processed instantly, making budgeting easy. Users can categorize or manually add transactions while enjoying privacy and data security.

Key Features for Skwad

Privacy-First Approach

Skwad's unique privacy-first approach allows users to manage their finances without ever sharing bank passwords. By utilizing email alerts, this feature ensures users maintain their security while effectively tracking and categorizing their transactions, making Skwad a trusted budgeting solution.

Instant Transaction Sync

Skwad provides instant transaction syncing through automated bank alerts, allowing users to receive and categorize spending as it happens. This feature ensures real-time financial updates, empowering users to stay informed and make quick budgeting decisions without delays.

Customizable Expense Tracking

Skwad offers fully customizable expense tracking options, enabling users to categorize, recategorize, split, or hide transactions based on personal preferences. This flexibility enhances budget management, allowing users to tailor their financial analysis uniquely to their needs.