Expense Sorted

About Expense Sorted

Expense Sorted offers an innovative AI-driven solution for automating expense categorization, perfect for busy individuals and small business owners. By securely integrating with Google Sheets, it simplifies your monthly budgeting process, saving time and enhancing financial management accuracy.

Expense Sorted provides flexible pricing plans tailored to various needs, with options for individuals and businesses. Each tier offers unique features such as advanced AI categorization and enhanced security. Upgrading unlocks additional benefits, making expense management even more efficient and user-friendly.

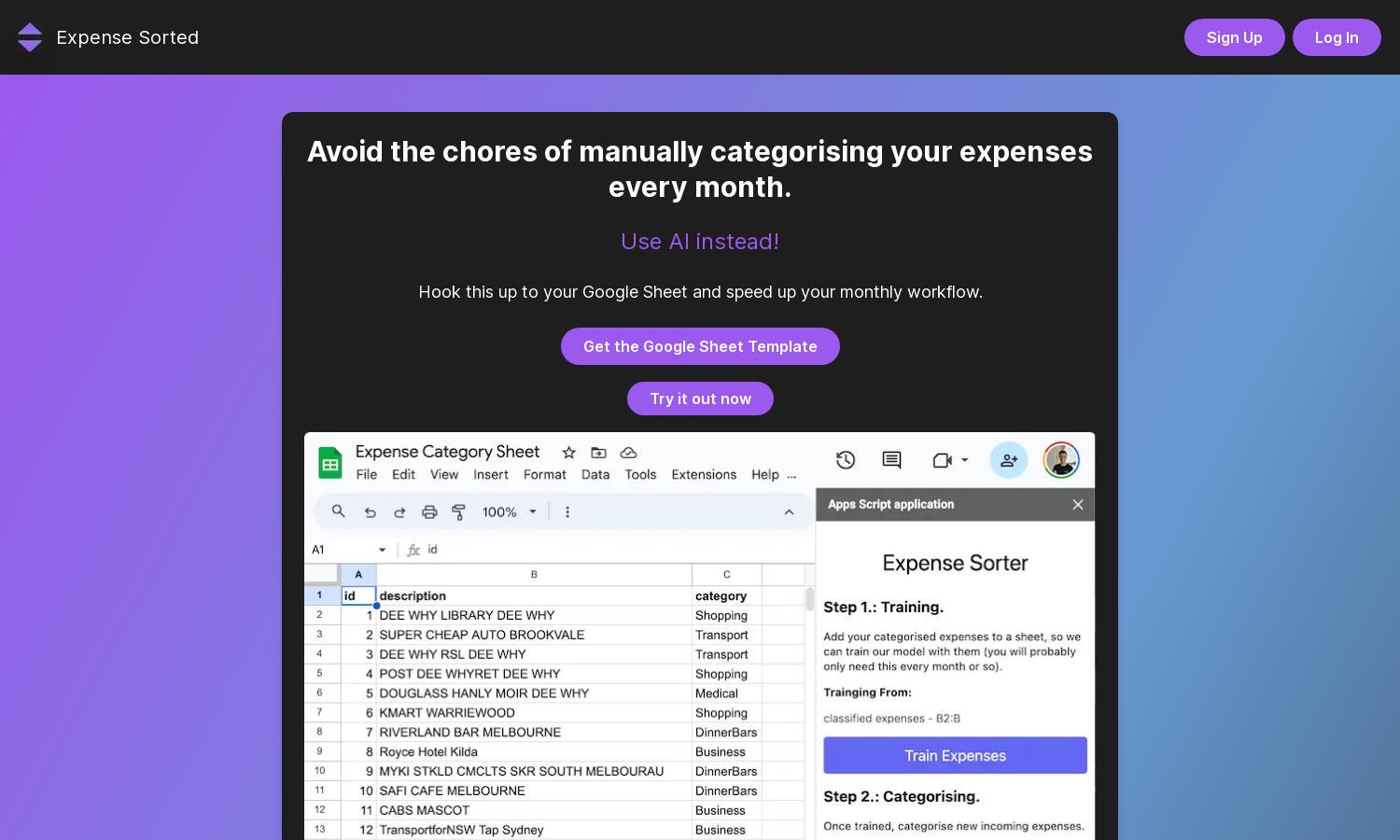

The user interface of Expense Sorted is designed for seamless navigation, featuring a clean layout that enhances user experience. Key functionalities are easily accessible, allowing users to categorize expenses quickly and efficiently, making financial management intuitive and straightforward.

How Expense Sorted works

Users of Expense Sorted begin by securely connecting their Google Sheets account to the platform. The setup is straightforward, involving simple steps to authenticate the integration. Once connected, the AI analyzes transaction data and automatically categorizes expenses, allowing users to review and adjust categories effortlessly.

Key Features for Expense Sorted

Automated Expense Categorization

Expense Sorted's automated expense categorization utilizes advanced AI algorithms to enhance budgeting efficiency. By intelligently identifying and classifying transactions, users save valuable time and reduce manual oversight, making financial management a breeze.

Customizable Categories

With Expense Sorted, users can customize expense categories to suit personal or business needs. This flexibility ensures that budgeting aligns with individual financial goals, making the platform adaptable for various user scenarios and enhancing overall usability.

Secure Google Sheets Integration

Expense Sorted features secure Google Sheets integration, prioritizing user privacy through advanced encryption methods like OAuth 2.0. This connection ensures that users can confidently manage their financial data without compromising security, a critical aspect for maintaining trust and reliability.

You may also like: