Teragonia

About Teragonia

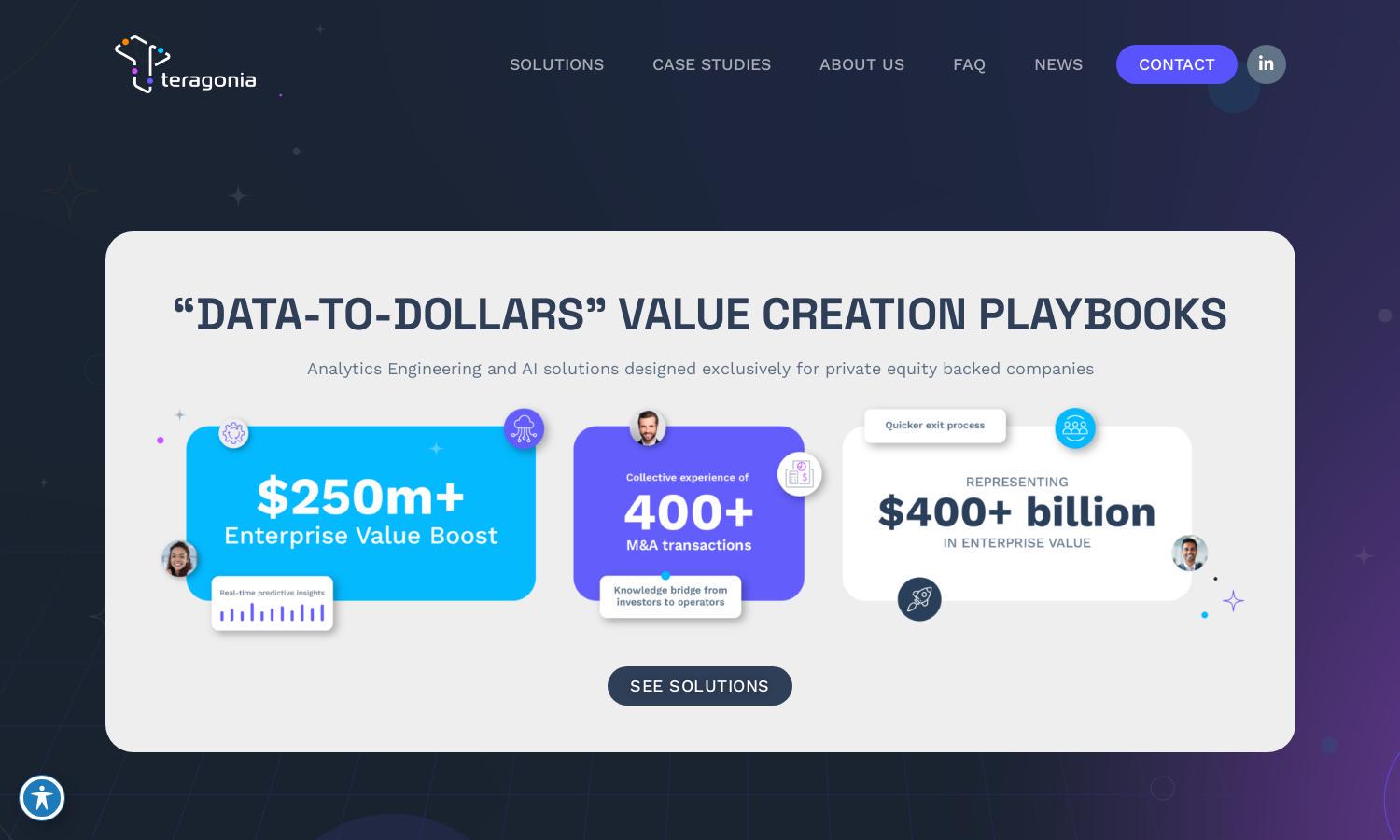

Teragonia focuses on providing targeted analytics engineering and AI solutions for private equity firms. Designed for both PE portfolio value creation and founder-owned businesses, Teragonia employs innovative technologies and expert insights that enhance decision-making, optimize data usage, and significantly boost EBITDA for users.

Teragonia offers customized pricing plans based on specific engagement agreements, allowing businesses to choose services that best fit their needs. Upgrading to advanced solutions enables users to unleash untapped data potential while maximizing analytics-driven investment returns, making each tier valuable for various portfolio scenarios.

In Teragonia, the user interface is designed for seamless navigation, providing straightforward access to analytics tools and data insights. Its intuitive layout enhances the user experience, while unique features like real-time KPI reporting ensure that users efficiently engage with essential business intelligence at their fingertips.

How Teragonia works

To begin with Teragonia, users undergo a straightforward onboarding process that includes assessing their analytics needs. Once onboarded, users navigate through a user-friendly dashboard, accessing various features like real-time data insights and playbooks tailored to enhance their operations. The platform simplifies data management and decision-making, driving strategic outcomes for private equity firms.

Key Features for Teragonia

End-to-End Analytics Solutions

Teragonia's end-to-end analytics solutions empower private equity clients to harness data effectively. By integrating comprehensive analytics engineering and AI insights, the platform enhances operational efficiency, enabling users to realize significant investment returns and make informed decisions that drive portfolio value creation.

Real-Time Data-Driven Insights

Teragonia provides real-time data-driven insights that transform decision-making for portfolio companies. By leveraging advanced analytics, users gain immediate access to critical performance metrics and KPIs, leading to informed strategies that enhance operational effectiveness and maximize value across private equity investments.

Innovative Playbooks for Value Creation

Teragonia's innovative playbooks guide users in implementing effective data strategies tailored to their business needs. These customizable frameworks ensure that private equity firms can seamlessly integrate analytics engineering and AI solutions, driving enhanced value creation and strategic alignment across their portfolio initiatives.