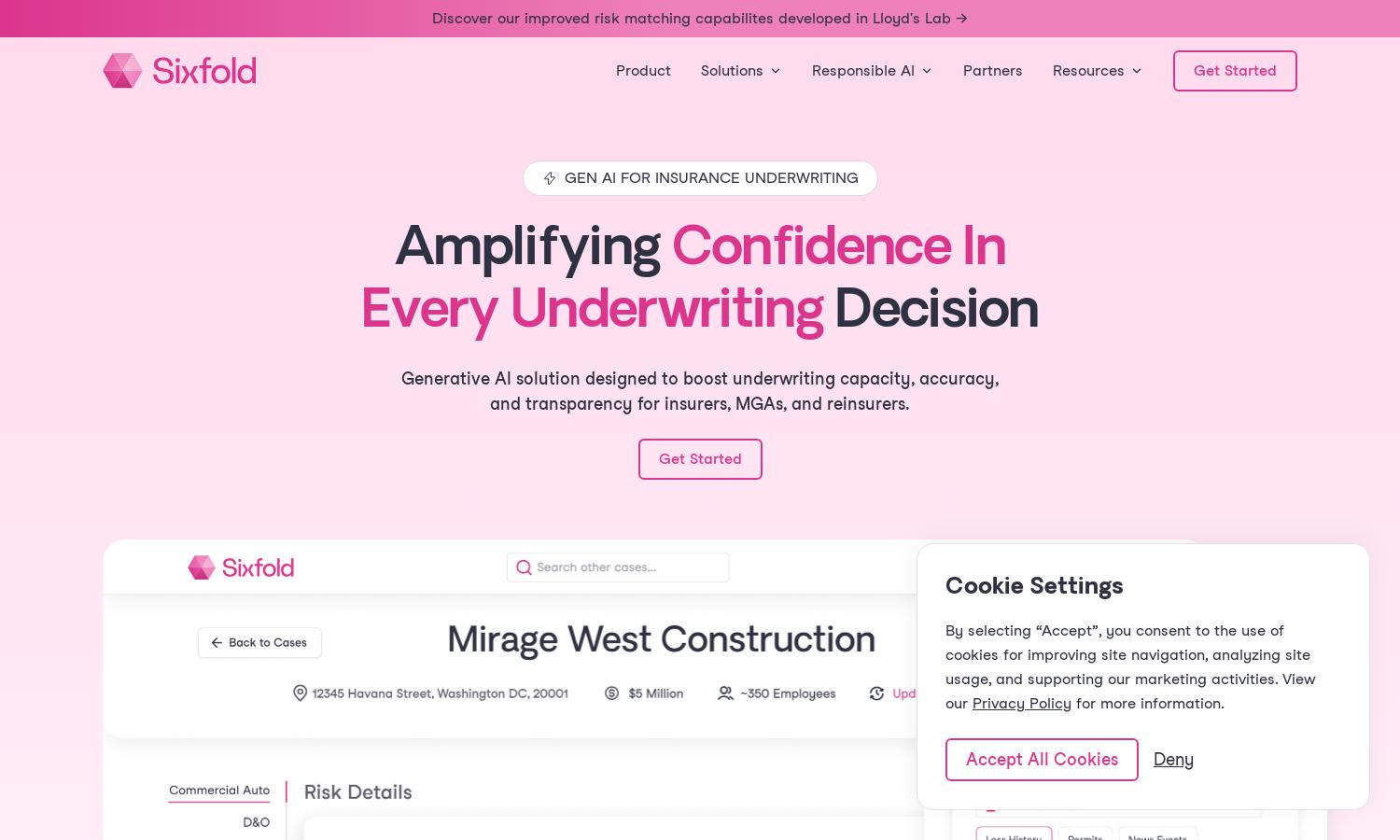

Sixfold

About Sixfold

Sixfold is a generative AI platform that enhances insurance underwriting processes, providing insurers with tailored risk insights and automating tedious tasks efficiently. With its unique ability to ingest underwriting guidelines and extract relevant data, Sixfold empowers underwriters to make informed decisions swiftly, ensuring compliance and transparency.

Sixfold offers flexible pricing plans catering to diverse insurance needs. Each tier provides unique features, including risk assessments and workflow automation. Users benefit from enhanced decision-making capabilities and efficient integrations, making upgrading essential for organizations looking to optimize their underwriting processes with innovative AI solutions.

The user interface of Sixfold is designed for seamless navigation, featuring intuitive layouts that enhance user experience. Its accessible design includes user-friendly tools for risk analysis and decision tracking, ensuring that insurance underwriters can operate efficiently while leveraging advanced generative AI capabilities for better outcomes.

How Sixfold works

Users begin by onboarding Sixfold by uploading their underwriting manuals, allowing the platform to ingest guidelines that identify risk factors. As users navigate, they can extract data from submissions and supporting documents. The AI then generates recommendations and summaries in a user-friendly format, enabling quick, informed decision-making and enhancing overall workflow efficiency.

Key Features for Sixfold

Automated Underwriting Recommendations

Sixfold's automated underwriting recommendations process leverages advanced AI to analyze guidelines and data, allowing for real-time decisions that align with an insurer's unique risk appetite. This feature enhances efficiency, providing underwriters with tailored insights that streamline their workflow and improve accuracy in assessments.

Risk Data Extraction

The risk data extraction feature of Sixfold collects and synthesizes critical information from various sources, including underwriting submissions and third-party resources. This capability ensures that users have access to comprehensive data sets for better decision-making. It simplifies the process, enabling underwriters to focus on high-level analysis instead of manual data collection.

Traceability and Transparency

Traceability and transparency are core features of Sixfold, ensuring all underwriting decisions are fully sourced and documented. Users can track inputs and outputs, eliminating the black box effect often seen in AI tools. This feature fosters trust and compliance, making it easy for teams to justify decisions to stakeholders.