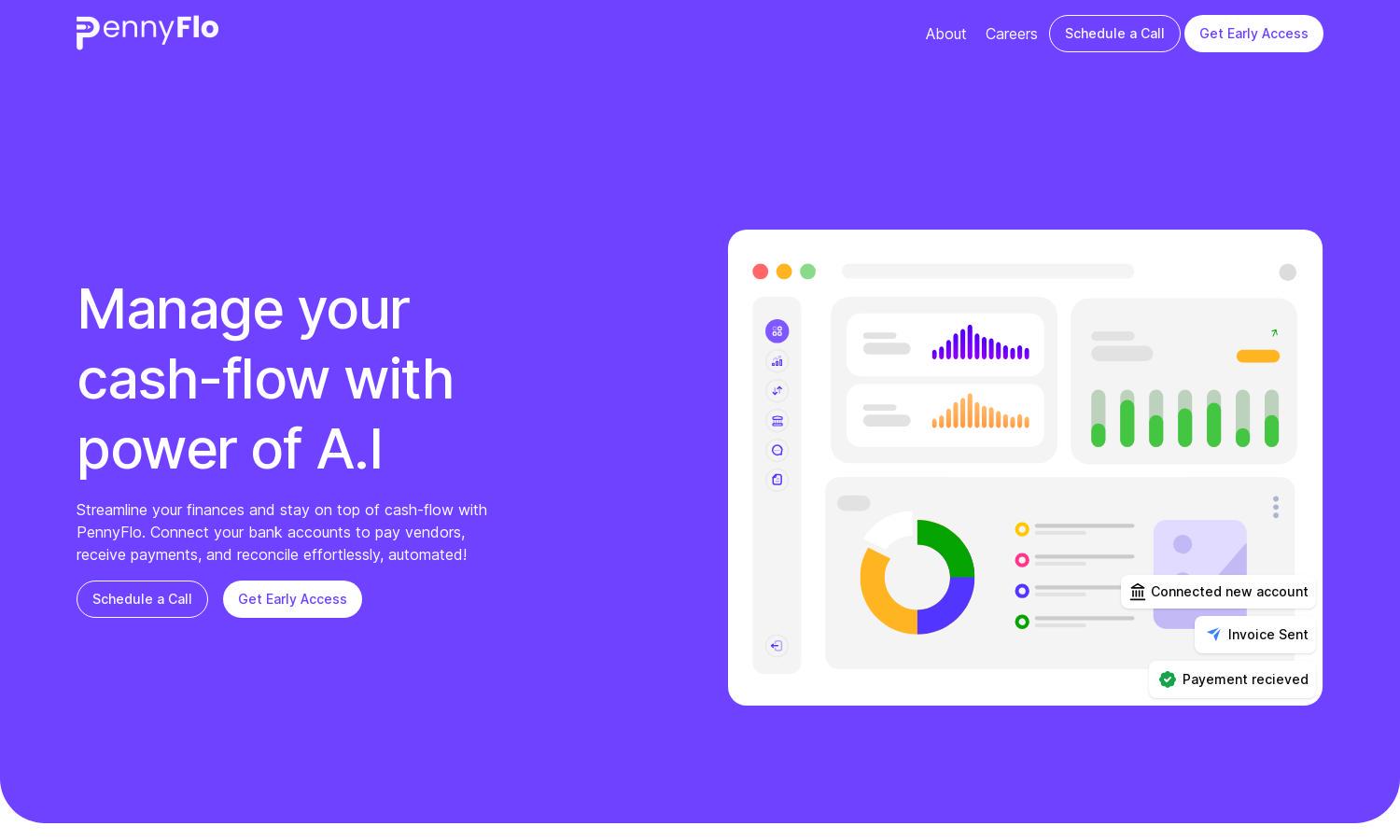

Pennyflo

About Pennyflo

Pennyflo is an innovative platform designed for businesses seeking efficient cash management solutions. By utilizing AI-powered tools, it simplifies financial processes, offering a unified view of cash flow in real-time. Users benefit from automated tasks and dynamic forecasts, enabling informed decision-making and enhanced efficiency.

Pennyflo offers flexible pricing plans tailored to suit various business sizes and needs. Each subscription tier provides unique features and capabilities, with potential discounts for annual commitments. Upgrading allows users to access advanced tools, enhancing overall financial management and optimizing cash flow.

Pennyflo boasts a user-friendly interface designed for seamless navigation and easy access to features. The layout focuses on enhancing the user experience, with intuitive workflows and visual data representation, allowing users to manage cash flow efficiently and effectively.

How Pennyflo works

Upon signing up with Pennyflo, users undergo a straightforward onboarding process, integrating their financial data into the platform. The intuitive dashboard provides easy access to essential tools, such as automated banking reconciliations and dynamic forecasting. Users can explore real-time cash flow insights, facilitate team collaboration, and generate comprehensive reports with minimal effort, optimizing their financial management processes through Pennyflo.

Key Features for Pennyflo

AI-Powered Co-Pilot

The AI-Powered Co-Pilot in Pennyflo revolutionizes cash management by processing complex cash flow information swiftly. This core feature enhances operational efficiency, enabling finance teams to automate tasks, mitigate risks, and make data-driven decisions, ultimately driving business success and sustainability.

Dynamic Forecasts

Pennyflo's Dynamic Forecasts feature empowers businesses to accurately predict financial scenarios using real-time data analysis. This key feature helps organizations plan for the future, anticipate cash flow needs, and make informed strategic decisions, enhancing overall financial stability and growth.

Automated Banking & Reconciliations

Automated Banking & Reconciliations in Pennyflo simplify financial operations by streamlining the reconciliation process. Users benefit from reduced manual workload and increased accuracy, allowing for timely financial insights and improved cash management, making it a unique asset for businesses.

You may also like: