Greenlite

About Greenlite

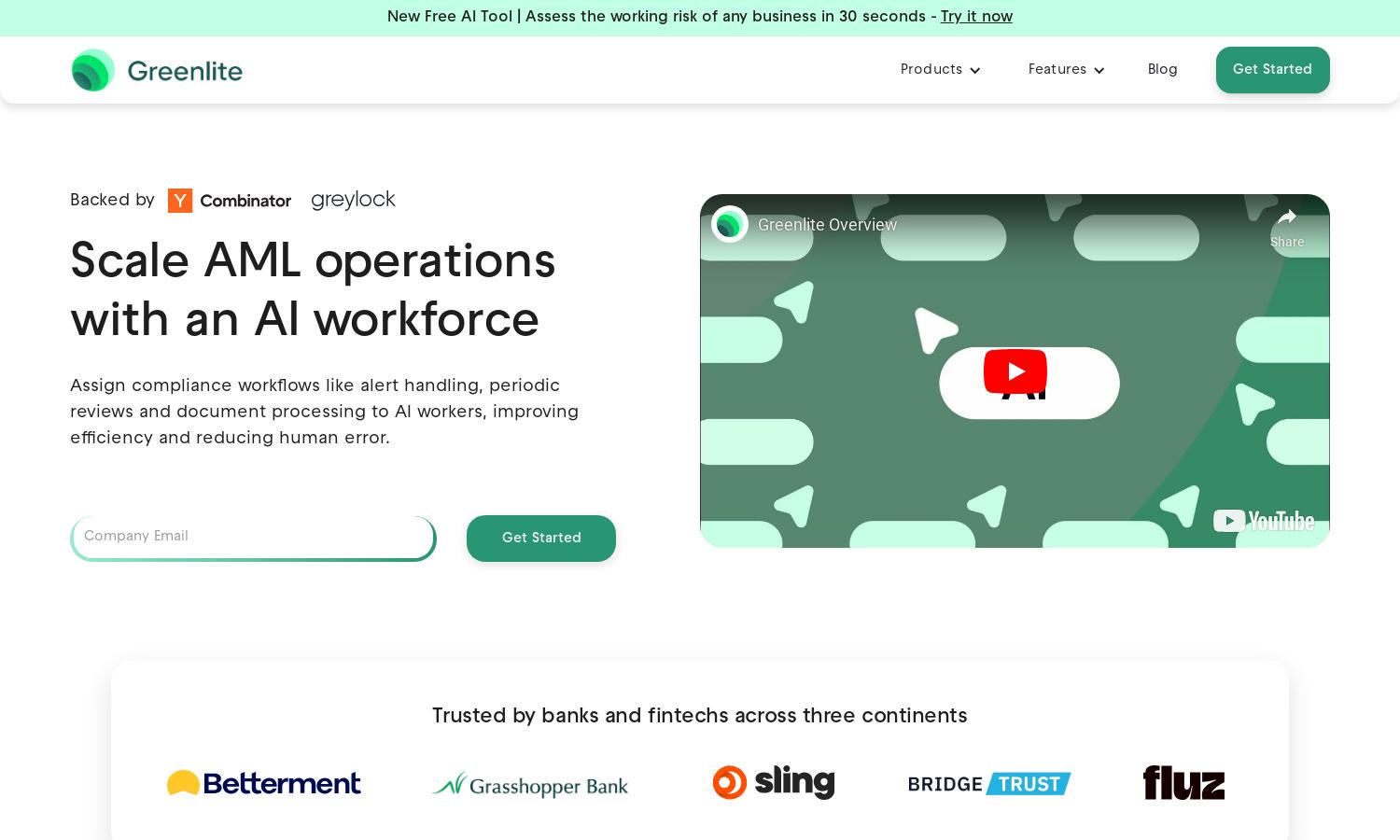

Greenlite is an innovative platform designed for financial institutions to automate compliance processes. By leveraging AI technology, it streamlines AML, sanction screening, and customer due diligence, allowing teams to focus on real risks and improve efficiency. With Greenlite, organizations can scale operations effectively and meet regulatory demands effortlessly.

Greenlite offers flexible pricing plans to cater to various financial institutions. Each tier provides distinct value, from basic compliance automation to advanced features for extensive risk management. Upgrading enhances operational efficiency, ensuring compliance teams can meet increasing demands and maintain high standards without sacrificing quality.

Greenlite boasts a user-friendly interface that simplifies compliance workflows. Its layout ensures seamless navigation and efficient access to key features, enhancing the overall user experience. With its intuitive design, users can easily engage with automation tools, making compliance tasks quicker and more efficient.

How Greenlite works

Users first onboard with Greenlite by integrating their existing systems via its robust API. Once set up, they can access a dashboard featuring all available tools for screening, customer due diligence, and transaction monitoring. The AI processes data and generates insights, enabling users to act swiftly on potential risks, consistently reducing manual workload and improving efficiency.

Key Features for Greenlite

Automated Compliance Workflows

Greenlite's automated compliance workflows streamline repetitive tasks, empowering financial firms to enhance their efficiency. By minimizing manual intervention, it allows compliance teams to focus on critical risk assessment rather than routine checks, thus improving overall operational effectiveness and enabling teams to respond to risks more proactively.

AI-Driven Risk Analysis

Greenlite leverages AI-driven risk analysis to provide accurate insights into customer compliance. This feature helps financial institutions quickly evaluate documentation, financial statements, and online presence, ensuring they effectively identify and mitigate potential risks before they escalate, ultimately strengthening their compliance programs.

Ongoing Monitoring and Reviews

The ongoing monitoring feature of Greenlite automates periodic reviews of high-risk customers. By consistently analyzing customer activity and documentation, it ensures organizations remain compliant and can proactively address potential issues, thereby enhancing their risk management strategies and reinforcing their overall compliance posture.