finbots.ai

About finbots.ai

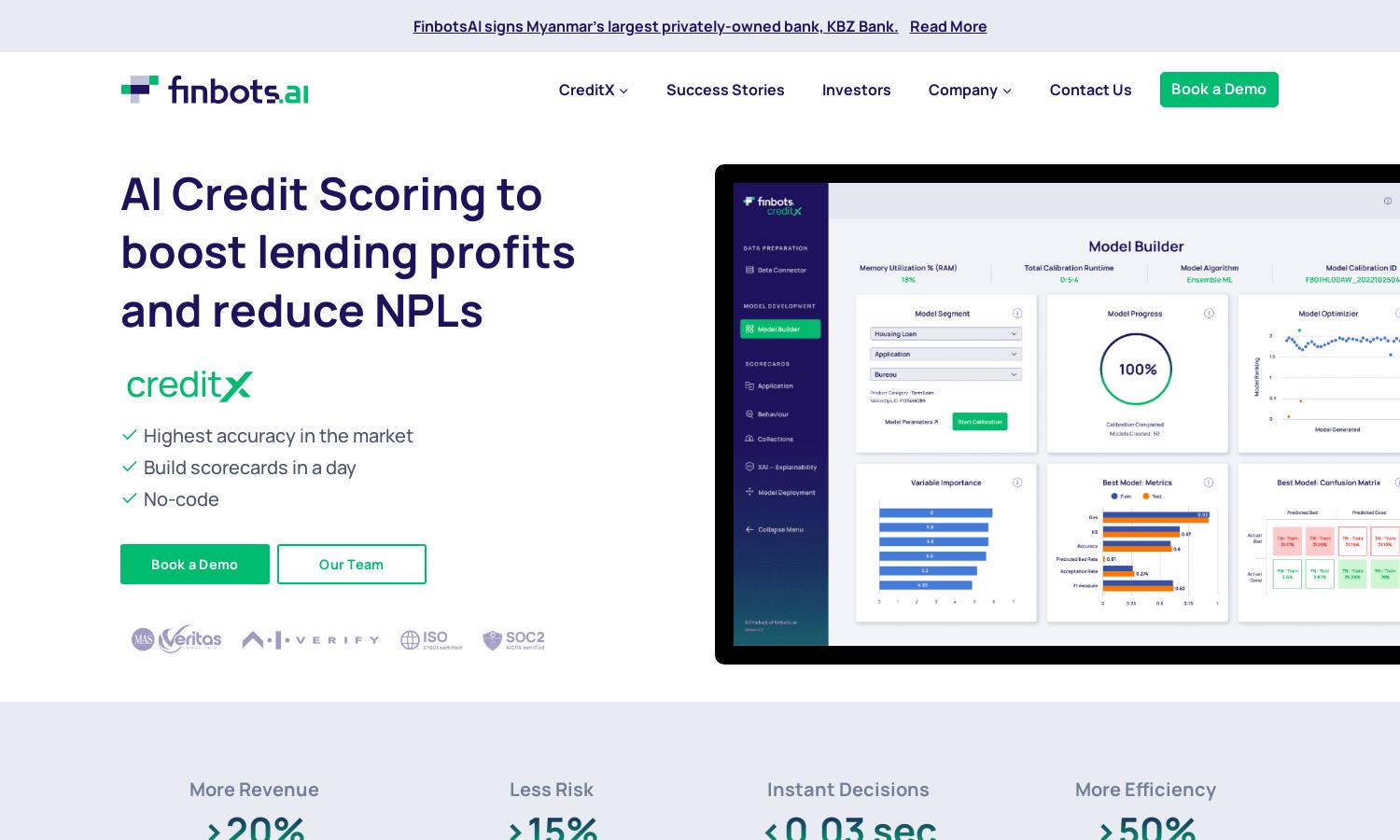

finbots.ai is a cutting-edge AI credit risk platform designed for financial institutions. It allows users to build and deploy highly accurate credit scorecards with no coding required, streamlining the lending process. By leveraging proprietary AI, finbots.ai enhances decision-making, reduces non-performing loans, and boosts profitability for lenders.

finbots.ai offers flexible pricing plans to suit various financial institutions. Users can choose affordable subscription tiers while benefiting from options to customize their solutions. The platform also provides a compelling 30% discount for the first six months, ensuring high-value offerings for both start-up lenders and established banks.

finbots.ai features a user-friendly interface that facilitates an intuitive browsing experience. Its layout promotes seamless interactions with powerful tools for credit scoring and model management, ensuring users can easily navigate the application. The clean design and accessible features make finbots.ai efficient for both tech-savvy professionals and newcomers.

How finbots.ai works

Users begin their journey with finbots.ai by signing up and connecting their data sources, including internal and external data. The platform automatically builds, validates, and deploys custom credit scorecards in a matter of hours instead of months. With real-time decision-making capabilities, users can efficiently manage credit risk while enjoying streamlined workflows and instant insights.

Key Features for finbots.ai

Automated Credit Scorecard Creation

The unique automated credit scorecard creation feature of finbots.ai allows for rapid development of highly accurate models. Users benefit from this advanced tool by significantly reducing the time and effort required for credit risk assessment, ultimately enhancing their lending efficiency and decision-making capabilities.

Real-Time Decision-Making

finbots.ai incorporates real-time decision-making features that enable lenders to make instant credit assessments. This key function enhances user experience by providing prompt insights and approvals, allowing financial institutions to serve their clients efficiently and effectively while maintaining a competitive edge in the lending market.

Robust AI Models

The robust AI models utilized by finbots.ai are validated by regulators to ensure exceptional accuracy and reliability. This distinctive feature enhances user confidence in the credit scoring process, allowing lenders to make informed and ethical decisions while minimizing risk and optimizing profitability in their operations.

You may also like: