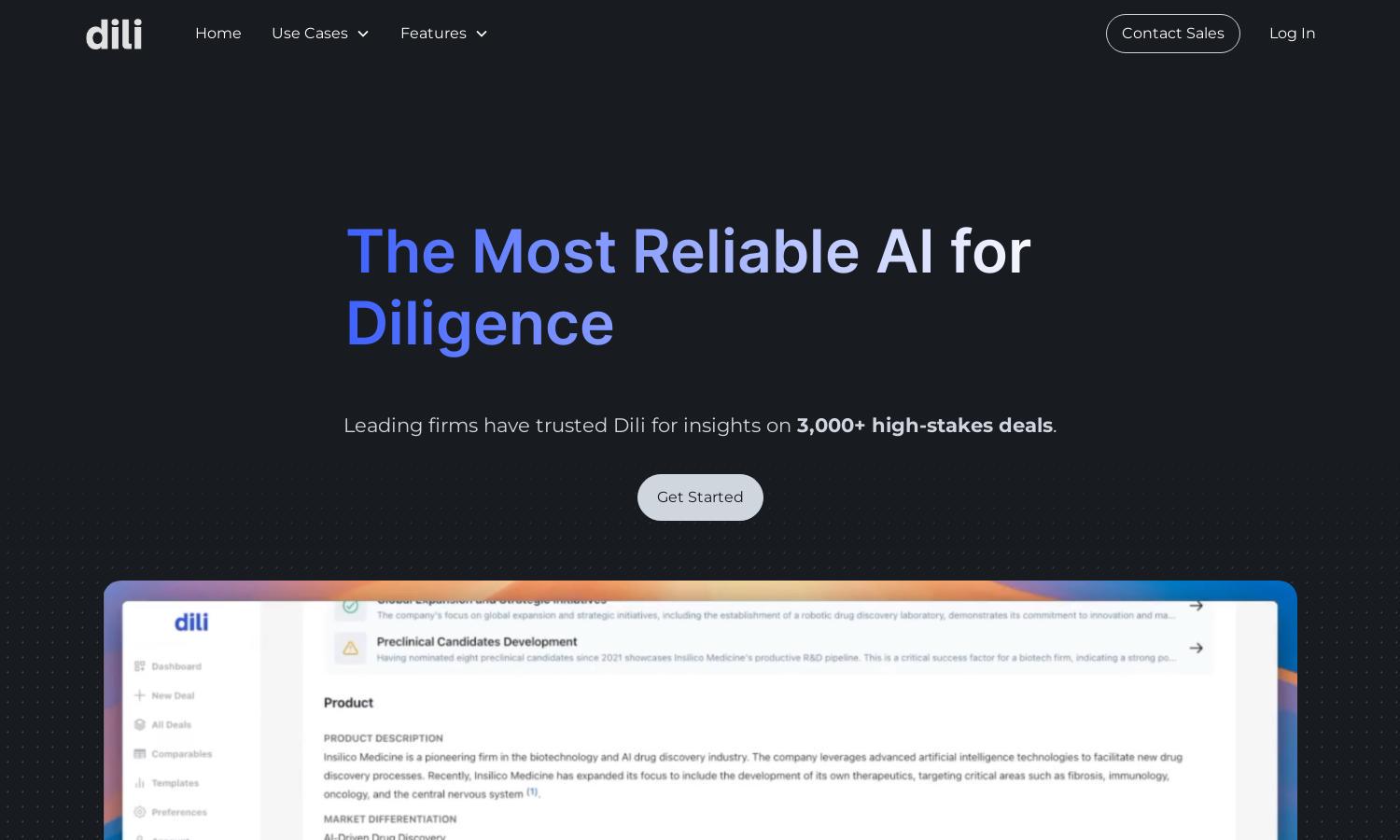

Dili

About Dili

Dili is an AI-powered diligence platform designed for finance professionals in real estate, private equity, and tax credits. By automating the generation of reports and memos and identifying potential risks, Dili enhances efficiency, helping users make informed investment decisions faster and with greater confidence.

Dili offers flexible pricing plans tailored to various business needs. Each subscription tier provides users with essential features, including automated report generation and risk assessment tools. Upgrading allows businesses to unlock advanced functionalities that enhance operational efficiency, making Dili a valuable investment for your team.

Dili features a user-friendly interface designed for seamless navigation and efficient document management. Its layout ensures users can easily access vital tools, uphold workflows, and maximize productivity. This intuitive design enhances the overall experience, making Dili an essential tool for investment professionals.

How Dili works

Users interact with Dili by first onboarding and inputting key metrics, questions, and potential risks. The platform then automates the analysis of transaction documents, generating instant reports and flags for potential issues. Dili’s custom workflows ensure that users can mirror their specific deal processes for optimal efficiency.

Key Features for Dili

Instant Report Generation

Dili's Instant Report Generation feature allows users to automatically create comprehensive reports from transaction documents, significantly reducing the time spent on due diligence. This unique capability ensures that finance professionals can quickly identify risks and insights, enhancing their decision-making processes.

Custom Workflow Automation

Custom Workflow Automation in Dili enables users to tailor their diligence processes according to specific requirements. By replicating workflows, users streamline data extraction, document checks, and report generation, improving efficiency and accuracy while leveraging Dili's AI-driven capabilities effectively.

Confidence Scoring

Dili's Confidence Scoring feature provides users with a reliability metric for every output, highlighting areas needing further scrutiny. This unique tool builds trust in the platform’s analyses, ensuring finance professionals can make informed decisions backed by data they can depend on.

You may also like: