Chart

About Chart

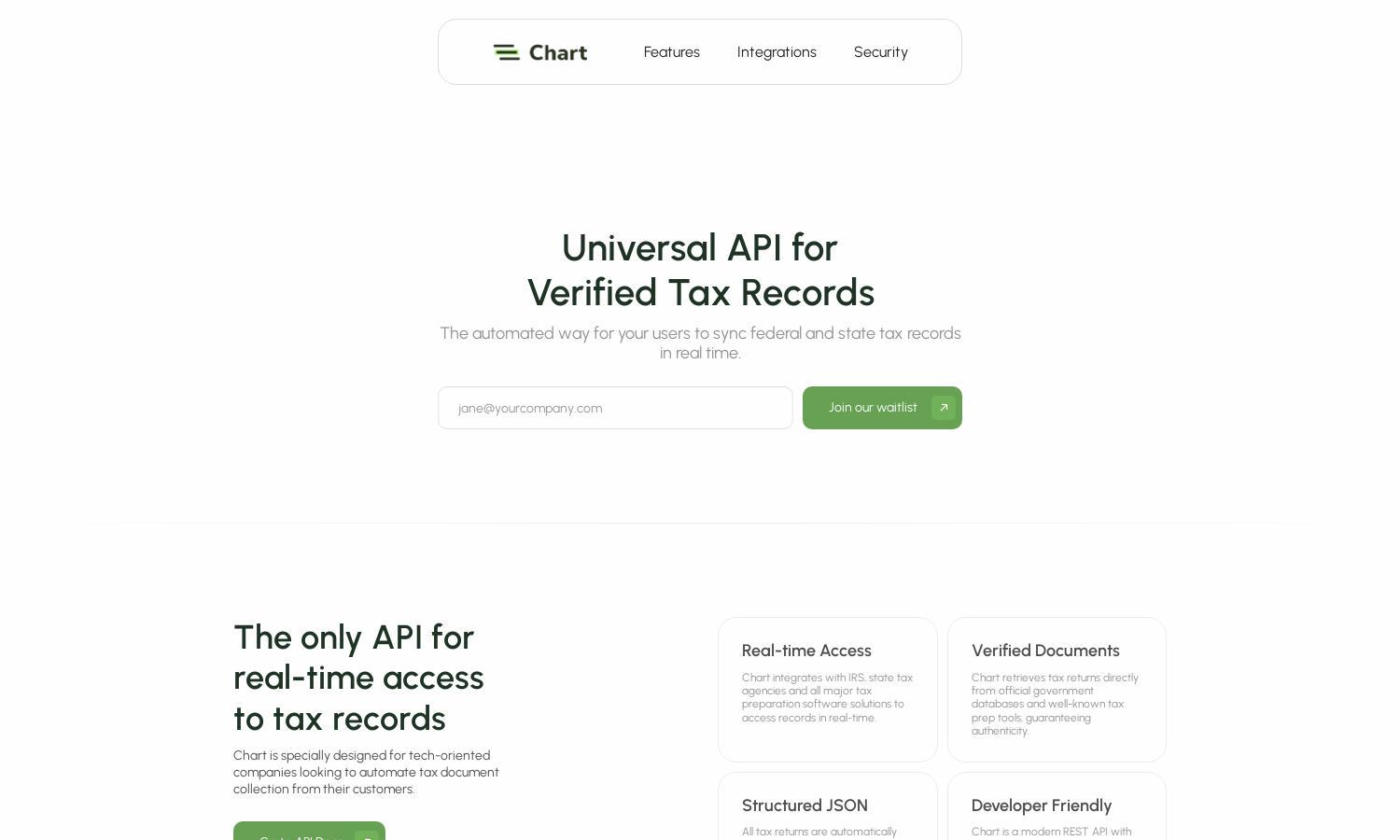

Chart is a universal API designed for tech-oriented companies needing efficient tax document collection. By integrating with IRS and state agencies, it offers real-time access to verified tax records. Users benefit from automated processes, enhanced security, and an intuitive consent flow that simplifies sharing necessary documents.

Chart offers customizable pricing plans with flexible tiers to accommodate various business needs. Each subscription unlocks enhanced features and integrations, providing significant value with real-time access to tax records. Consider upgrading to take advantage of advanced functionalities and dedicated support for increased efficiency in tax document collection.

Chart features a sleek, user-friendly interface that promotes seamless navigation. The layout is designed for intuitive access to key functionalities, such as real-time tax record integration and document submission options, ensuring users can efficiently manage their tasks while enjoying a hassle-free browsing experience.

How Chart works

Users interact with Chart by first creating an account and completing an onboarding process that familiarizes them with its features. After logging in, they can connect their IRS and state tax accounts, submit tax preparation software details, or upload PDFs to access verified tax records. Chart's streamlined consent flow ensures users control which documents to share, enhancing their experience while maintaining security and privacy.

Key Features for Chart

Real-time Tax Record Access

Chart stands out with its real-time access to verified tax records. This feature allows users to collect and manage tax documents effortlessly, integrating seamlessly with major tax preparation software and government agencies. Users benefit from automated processes and enhanced security, making tax document management simpler.

Verified Document Retrieval

Chart excels in retrieving verified tax documents directly from official government databases and trusted tax prep tools. This ensures authenticity and reliability, vital for users needing accurate tax records. With this feature, Chart guarantees peace of mind, knowing data is sourced from reputable origin points.

Enterprise-Grade Security

Chart prioritizes user security with non-persistent credentials, requiring re-login for each session. This unique approach safeguards sensitive information while complying with major frameworks. Users can feel confident that their tax data is protected, making Chart a trusted partner in tax document management.

You may also like: