Addy AI

About Addy AI

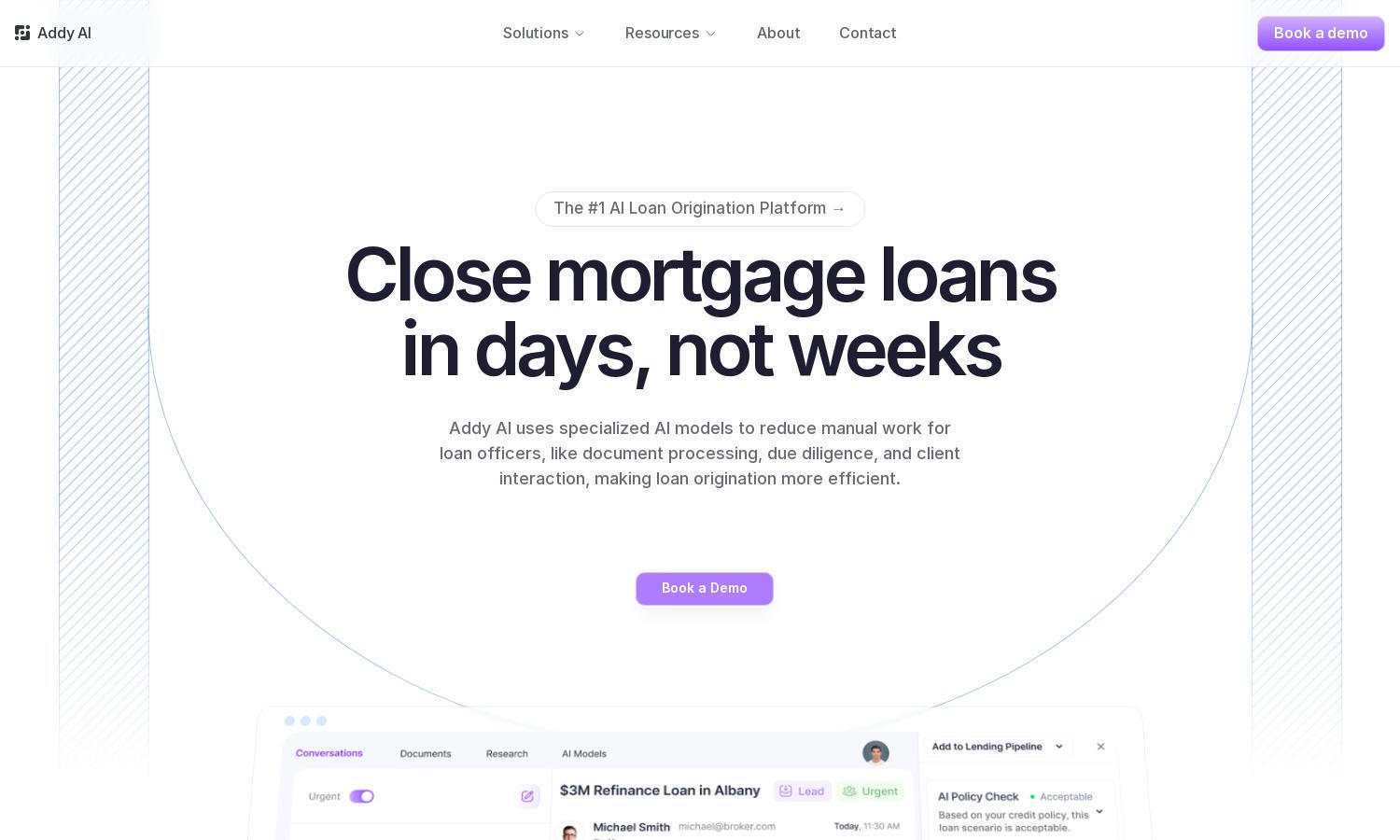

Addy AI revolutionizes mortgage lending by automating the loan origination process, enabling lenders to close loans significantly faster. With custom AI models, Addy AI saves loan officers up to 10 hours a week, improving efficiency in document processing and client communications. Experience streamlined workflows and enhanced productivity with Addy AI.

Addy AI offers various pricing plans designed for different lender needs. Each tier provides valuable features like automated document processing and CRM integration. Upgrading brings enhanced capabilities and saves even more time, improving operations for mortgage professionals. Explore your options with Addy AI to maximize your team's efficiency.

The user interface of Addy AI is designed for seamless navigation and intuitive interactions. Its clean layout ensures that users can effortlessly access features, making the loan origination process smooth and efficient. Unique tools, like conversing with documents in natural language, enhance the overall browsing experience for mortgage lenders.

How Addy AI works

Users start by signing up for Addy AI and onboarding their existing workflows, integrating with their CRM and loan origination systems. Once set up, they can train custom AI models tailored to their specific needs. Addy AI then automates tasks such as document processing and client follow-ups, allowing users to manage their loans more efficiently while providing fast assessments and seamless interactions.

Key Features for Addy AI

Automated Document Processing

Addy AI's automated document processing feature dramatically reduces manual workload for loan officers, speeding up the loan origination process. By leveraging advanced AI technology, users can extract relevant data in seconds, ensuring efficiency and accuracy. This unique functionality saves valuable time and enhances the overall lending experience.

Custom AI Model Training

Addy AI allows lenders to train custom AI models that adapt to their specific loan policies. This unique feature enables efficient automation of tasks like client follow-ups and eligibility assessments, delivering a personalized experience to borrowers. Enhance your lending operations with tailored AI solutions from Addy AI.

Real-Time Loan Assessments

Addy AI offers real-time loan assessments, instantly determining borrower eligibility based on credit policies. This feature streamlines the qualification process by providing actionable suggestions for improving applications. With its immediate feedback capabilities, Addy AI empowers lenders to make informed decisions quickly, enhancing client satisfaction and operational efficiency.

You may also like: